Term vs. Whole Life Insurance: Which Is Right for You?

February 14, 2024

Choosing the right life insurance isn't just about picking a policy; it's about securing your loved ones' future and finding peace of mind in knowing they'll be taken care of. With so many choices out there, it's essential to understand the differences between term life and whole life insurance insurance. These are two of the most common options, each offering unique benefits and considerations.

Take your time to explore these options and consider what matters most to you and your family. Your decision will shape their future, providing the support and protection they need long after you're gone.

Understanding Term Life Insurance

Term life provides coverage for a specific period, typically five to 30 years. It offers financial protection to your beneficiaries in the event of your premature death during the term. Key features include affordability, lower premiums compared to other types of life insurance, and flexibility in term lengths.

Term life insurance allows you to tailor the policy to your specific needs, but it has limitations. Coverage ends once the term expires, requiring renewal or purchase of a new policy, and the absence of a cash value component that builds over time. It also has advantages, such as accessibility to a wider range of policyholders, simplicity, and the ability to cover specific financial obligations.

Delving Into Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides lifetime coverage and combines a death benefit with cash generation. A portion of the premium payments goes to the cash value, which grows tax-deferred over time, allowing policyholders to accumulate wealth alongside their life insurance coverage.

The main advantages of whole life policies include lifetime coverage (as long as premiums are paid) and guaranteeing a death benefit payout to beneficiaries regardless of when the policyholder passes away. These policies also have a cash value component, which policyholders can borrow against for various financial needs.

However, whole life insurance also has drawbacks, such as higher premium costs than term life insurance.

Factors to Consider When Choosing Between Term and Whole Life Insurance

When deciding between term and whole life insurance, reflect on not only your financial goals and priorities but also your dreams, aspirations, and the legacy you wish to leave behind. Consider your budget and affordability, as term life generally offers lower premiums, making it more accessible for those with limited financial resources. Whole life might be a viable option for those with a stable income and the ability to afford higher premiums.

Assess your coverage needs, whether short-term or long-term, as term life can provide necessary coverage for temporary financial obligations. In contrast, whole life insurance offers lifelong protection and a guaranteed death benefit.

You can further customize your coverage for both types of insurance with riders. A rider is an optional coverage or feature you can purchase and add to your life insurance policy. Ask your agent about which riders are available on your product.

When You Can Choose Both: Whole Life and Term Insurance

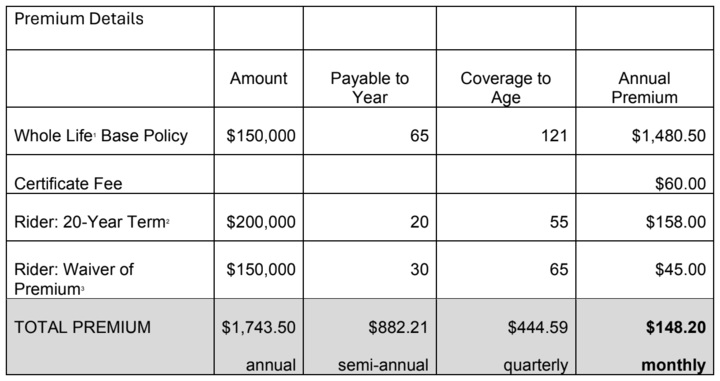

A combination of both whole life and term insurance gives the insured an element of maximum coverage for dollars spent--this can be done by purchasing a rider. A whole life policy with a term insurance rider helps the insured to stay within budget while providing needed coverage, and establishing a permanent, cash value policy.

See the sample below:

Male, Age 35, preferred nonsmoker

Products/features may not be available in all states. Sample for illustration purposes; actual premiums and coverage will be based on age, health history, certain underwriting criteria, location, gender, and tobacco usage. See rider form for limitations. 1) 13WL Plan Series. 2) 17RI-LTI Series. 3) 17RI-WP Series. Provision that pays the premium for the insured during a period of disability. It also waives your rider premiums.

Tips for Making an Informed Decision

As you weigh the options between term life and whole life insurance or a combination of both, remember it's not just about comparing figures; it's about securing the future of those you hold dear.

Imagine knowing your family will be cared for, even if you're not there to provide for them. That's the emotional anchor behind every decision you make.

If you find yourself unsure or overwhelmed by the choices, know you're not alone. At 1891 Financial Life, we're here to guide you through this journey, ensuring your decisions are not only financially sound but also emotionally fulfilling. Your family's security is our priority, and together, we'll find the ideal policy to safeguard their future, no matter what life may bring. Take the first step and contact 1891 Financial Life to find the right fit for you.

About 1891 Financial Life

At 1891 Financial Life, we don’t just sell policies, we offer possibilities. We pride ourselves on giving back to the communities that we serve by providing quality and comprehensive insurance solutions. We are a not-for-profit life insurance Society, which means the sales from these financial service products help fund member benefits along with social, educational, and volunteer programs designed to respond to community needs. In 2023, 1891 Financial Life was listed by Forbes as one of "The World's Best Life Insurance Companies."

Our portfolio is extensive, ranging from various life insurance policies to our annuities to support your financial needs no matter what stage of life you’re in.